Similar to “Opportunity Scholarship” private school vouchers, the funding mechanism proposed in SB144 acts as an end run around the regular, biennial budget process.

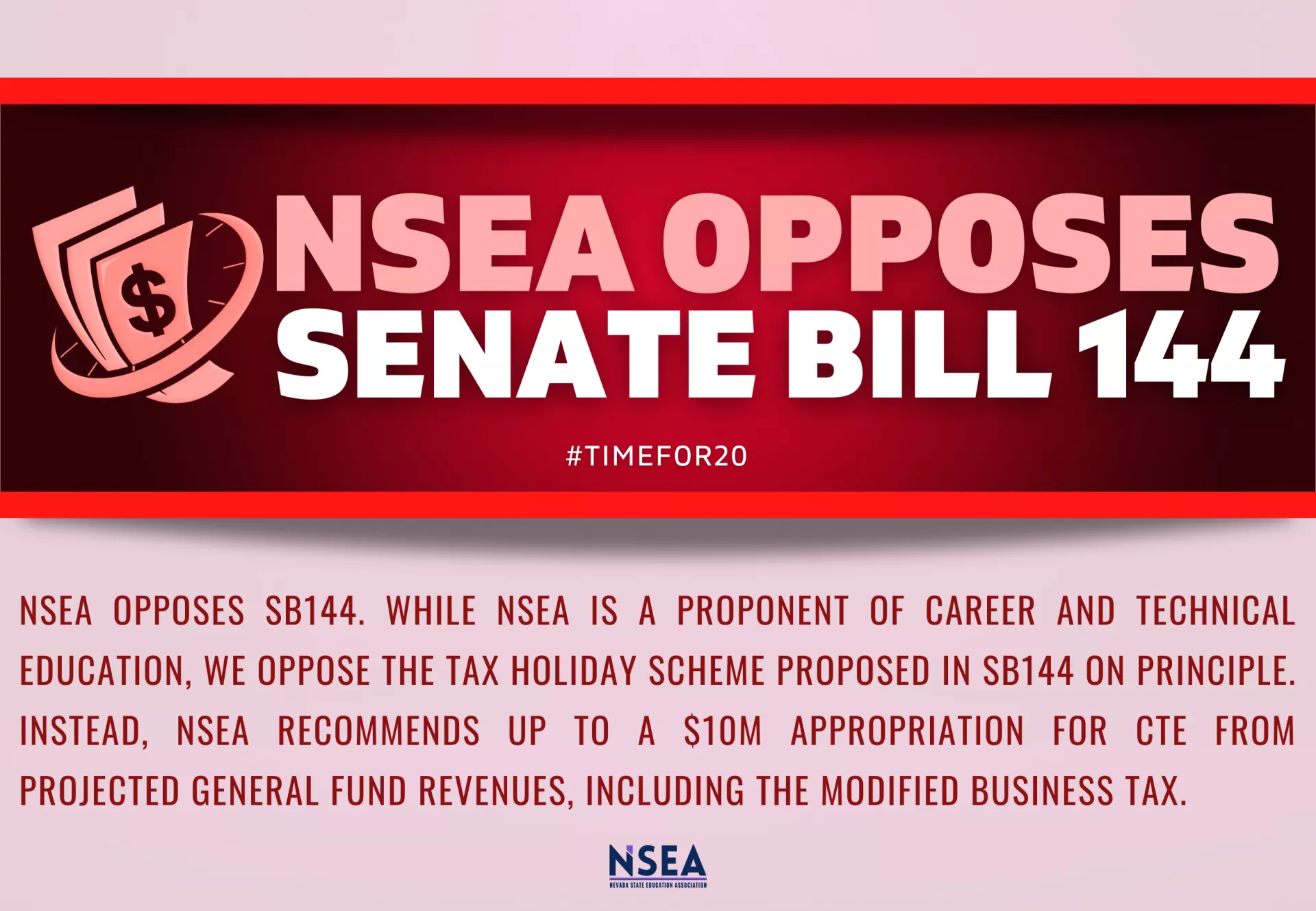

While career and technical education is worthy of additional funding, the mechanism in SB144 is the wrong way to do it. Granting businesses a dollar-for-dollar tax break gives corporations the veneer of giving without any actual charity. Instead, this tax break reduces state revenue, creates more bureaucracy, and limits the say of future elected officials in determining state priorities.

NSEA believes the legislature should support career and technical education by prioritizing these programs within the regular budget process.