During the regular session, NSEA repeatedly called to Pass the Plan offered by the Commission on School Funding. Instead, Nevada schools were left with the Governor’s two-dollar education budget. Only a few months into the school year, we can already feel the impact of this inadequate funding. In almost every district, educator pay is now falling behind the cost of living. This includes many teachers in Clark County who are receiving a reduction in take-home pay this year. Teachers in Washoe are working under last year’s contract. Meanwhile, districts across the state are facing structural budget deficits. Here in Carson, the district used $3.4M in reserves to balance this year’s budget. Both Clark County and Washoe are planning for structural deficits in the tens of millions of dollars. Meanwhile, the Douglas County School District is in a world of hurt financially. Already, educators have bene laid off from CCSD, and discussions about possible furloughs or pink slips are happening in Douglas and Mineral who is facing skyrocketing health insurance premiums.

There is a financial emergency in Nevada, but the answer does not include giving away future state tax dollars to Hollywood executives. Study after study shows that film tax credits, whether for an existing industry or to lure studios or production to a new location, cost more than they bring in. In California, the Legislative Analyst Office found that California had made 65 cents for every dollar spent on film tax credits. An audit conducted for New York State’s Department of Taxation and Finance found their film tax incentives only produced 31 cents in direct and indirect revenue for every dollar spent. Meanwhile, Georgia has built a significant film industry with the lure of tax credits. However, the Georgia State University Fiscal Research Center found that Georgia only saw 19 cents of revenue for every dollar the state spent.

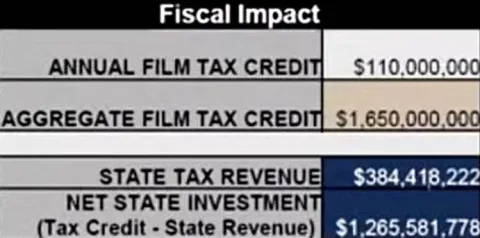

That is why the project sponsor’s own financial analysis shows AB5 is a big loser for the State of Nevada, with a net cost of $1,265,581,778. The Legislature’s Fiscal Division agrees. According to Sarah Coffman’s testimony, with the passage of AB5, Nevada’s budget would sink to $351.1M below the minimum ending fund balance by 2031. “As such, expenditures would either have to be cut by those dollar amounts or revenue enhancements would have to be approved.”

During the presentation of AB5, very little attention was paid to these numbers, but much was made about Pre-K funding for the Clark County School District. While $12M per year for Pre-K is great, this is not new revenue. It is a mechanism to capture funds that otherwise would accrue to the County. NSEA supports Pre-K, and like economist J.C. Bradbury pointed out, if you want more Pre-K funding, just provide it directly.

In terms of impact to CCSD, the decreased revenue to the state caused by AB5 would mean a loss of over $20M/year in support from the state’s Education Fund through the current school funding formula. CCSD may be the sole beneficiary of Pre-K funds, but like every other school district in Nevada, will lose funding with the passage of AB5.

We urge legislators to reject AB5 in the strongest possible way and turn to working on the real financial crisis looming over the state.

What's On Your Mind?